Need SR-22 insurance assistance?

CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance |

Steering through the complexities of insurance for high-risk drivers can be quite the challenge. While it's often seen as a necessary inconvenience, understanding how your driving history influences premiums is essential. Factors like DUIs and multiple violations can greatly hike your rates, sometimes by 25% or more. Knowing how insurers assess aspects like credit scores and vehicle types can make a difference, but what steps can you take to potentially lower those costs?

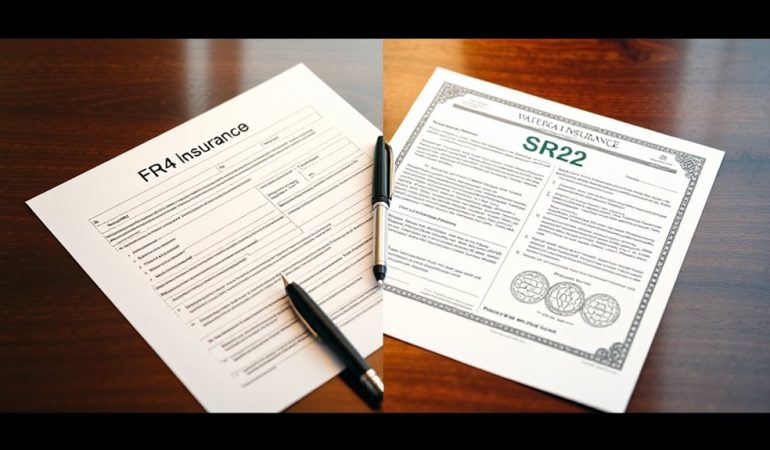

Navigating through the world of auto insurance can be particularly overwhelming for high-risk drivers, who often find themselves facing higher premiums and limited options. High-risk drivers are typically classified based on poor driving histories or other risk factors such as multiple accidents, DUI convictions, and excessive driving violations. Insurance companies evaluate these factors alongside your age, credit score, and the type of vehicle you drive to determine your risk level, which ultimately influences your premium costs. Additionally, FR-44 insurance may be required for those with severe violations, adding another layer to the insurance process.

One of the most notable contributors to a high-risk classification is a DUI conviction. A single conviction can drastically increase your likelihood of being deemed a high-risk driver. Similarly, having multiple moving violations or being involved in serious or frequent accidents raises your insurance risk. Additionally, lacking a valid license or insurance can further complicate your situation, as these factors reflect negatively on your driving credibility. Surprisingly, poor credit can also play a role in how insurers perceive your risk, impacting your overall insurance rates. Insurers assess risk based on historical data, so maintaining a clean driving record is vital for improving your classification over time.

A DUI conviction significantly increases your classification as a high-risk driver, affecting your insurance rates alongside other driving violations and credit history.

As a high-risk driver, you're likely to pay about 25% more for auto insurance than your safer counterparts. However, premium costs can vary considerably depending on the insurance provider. Some companies specialize in offering coverage for high-risk drivers, potentially providing more competitive rates for non-standard risks. While high-risk policies often include the same coverage options as standard policies, some insurers may limit your coverage or require higher deductibles, impacting your overall financial responsibility.

Common coverage options for high-risk drivers typically include liability coverage, collision, and extensive coverage. Additional features like personal injury protection (PIP) and uninsured/underinsured motorist coverage may also be part of your policy. It's important to verify that your policy meets the minimum state insurance requirements, as driving without insurance is illegal and can lead to severe penalties.

To lower your insurance premiums, you can adopt several strategies. For instance, maintaining a clean driving record over time can help improve your risk classification. Avoiding excessive moving violations is another effective way to lower your premiums. Completing defensive driving courses may also enhance your risk status, demonstrating a commitment to safer driving.

It's important to compare rates among various insurers, as this can help you identify more affordable options. Additionally, working on improving your credit score can positively impact your insurance rates.

Finding high-risk insurance options can be challenging, but certain insurance companies cater specifically to high-risk drivers. Independent agents can assist in shopping multiple carriers to find competitive rates. High-risk insurance remains vital for guaranteeing that all drivers meet state requirements, providing necessary coverage even for those with severe violations. Although finding affordable options may require extra effort, it's important for maintaining legal compliance and protecting your financial interests.

Conclusion

In summary, maneuvering through insurance as a high-risk driver can be challenging, but understanding the factors at play is essential. Did you know that high-risk drivers can pay up to 25% more in premiums than their standard counterparts? By actively working to improve your driving record and credit score, you can gradually reduce your costs. Staying informed and making strategic decisions can lead to more affordable insurance options, helping you regain control over your financial future.